It’s in Your Best Interest to Understand APR & APY

When shopping for a mortgage, credit card, savings account, or certificate, it’s important to understand what those APR and APY acronyms mean after the interest rate, so that you can intelligently compare offers. Consumers typically look for the lowest rate on a mortgage and the highest rate for a savings account. However, when you look at APR (annual percentage rate) or APY (annual percentage yield), you’ll get a clearer picture of how much you’ll earn or pay, and can more easily compare apples to apples from different banks or credit unions.What is Interest?

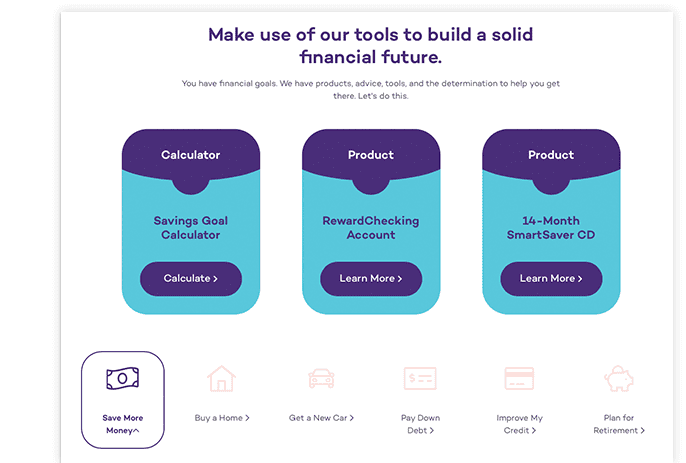

To understand APR and APY, you first need to understand the concept of interest. Interest is simply the cost of using someone else’s money, and is calculated as a percentage of a loan or a deposit. For example, if MECU lends you money for your next car in the form of an auto loan, you’ll pay interest on top of the amount borrowed to pay for the car. On the flip side, if you save money into your MECU high-interest checking, Certificates, IRAs, Money Market, or Savings account, that too earns interest, based on the current interest rate.Another term to understand is compound interest, which put simply, is the interest paid on both the principal (original amount of loan or savings) plus the interest you earned or paid in previous periods. The more often your interest is compounded, the more money you’ll either earn or pay in interest.

Using APR to Compare when Borrowing Money

When shopping for the best mortgage, credit card, or loan, most consumers shop around for the lowest interest rate. However, some lenders offer very low interest rates but have high closing costs and fees, which makes the loan a lot more expensive. This is a common practice in the payday lending industry and online mortgage lenders. So, what’s a borrower to do? Compare using APR!

Loan, credit cards and mortgage costs aren’t only made up of interest rates, but include fees and other costs. APR is the total cost of borrowing money, calculated annually over the life of the loan. The APR calculation that takes other elements into account to give you a true total cost of a loan, so you can compare offers from different lenders. Let’s use two mortgage quotes to understand this further:

| Home Loan Costs | MD Bank 1 | MD Bank 2 |

| Loan Term | 30 years | 30 years |

| Loan Amount | $150,000 | $150,000 |

| Interest Rate | 3.50% | 3.75% |

| Closing Costs | $6,000 | 1,000 |

| APR | 3.82% | 3.80% |

| Monthly Payment | $701 | $699.30 |

| Total Interest | $102,183.50 | $101,750 |

As you can see from this example, MD Bank 1 offers a lower interest rate, but much higher closing costs. MD Bank 2 offers a higher interest rate with much lower closing costs. This makes the actual loan total less for the total cost of the mortgage that has a higher interest rate. Thanks APR!

It is important to note that other factors like your credit score, come into play when determining your actual interest rate and APR. That’s why we’ll provide a Truth in Lending document (TILA) to estimate your APR, and will connect you with a MECU loan officer to help you make an informed decision. Also, make sure to compare the same loan terms when looking at various offers.

Using APY to Compare Deposit Accounts

When shopping for a certificate or savings account, the best way to compare accounts is by looking at the APY (the annual percentage yield). APY takes the frequency of the compounding interest into effect, as well as the interest rate. The higher the APY the more money you’ll earn. Banks and credit unions have different compounding frequencies. Some offer daily compounding, others compound monthly, or quarterly, or annually.“You earn a yield and pay a rate.”

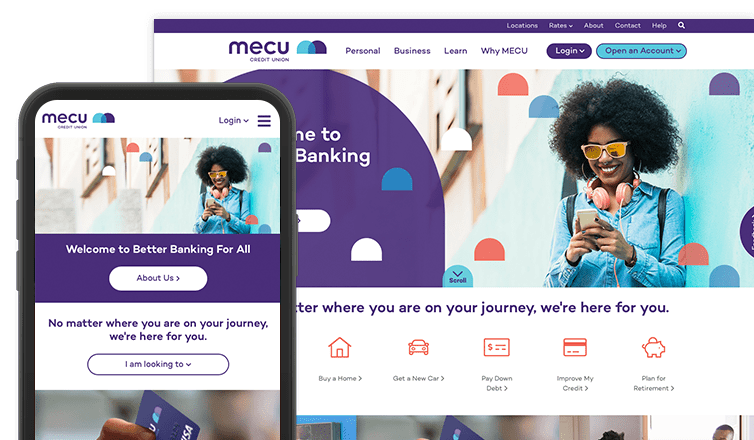

An easy way to remember the difference between APR and APY is to use the adage, “You earn a yield and pay a rate.” Understanding how interest works and which calculations you should use to compare offers on loans and savings, money market accounts of CDs is an important step in becoming financially fit. If you’d like to talk to us about our savings options or meet with a loan officer, please contact us or visit us at any of our Baltimore, MD locations.