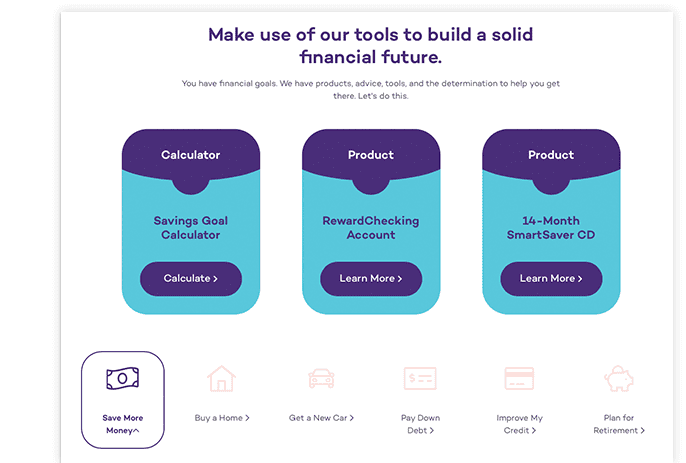

Get more for your money with our leading CD rates.

Certificates of Deposit (CDs) are not a one-size-fits-all savings option. You can choose from investments of various lengths, ranging from six months to five years. Although all of MECU's CDs offer exceptional returns, you can often get a higher rate if you invest for a longer period.

| Account Type | Annual Percentage Yield (APY) | Minimum Initial Deposit |

|---|---|---|

| 60-month | 2.60% | $500 † |

| 48-month | 2.45% | $500 † |

| 36-month | 2.40% | $500 † |

| 24-month | 2.30% | $500 † |

| 18-month | 2.25% | $500 † |

| 14-month Smart Saver ** | 2.00% | $50 † |

| 12-month | 2.20% | $500 † |

| 9-month | 1.90% | $500 † |

| 6-month | 1.30% | $500 † |

† Minimum balance in order to earn stated APY.

* Early withdrawal penalty may be imposed for withdrawal of principal before the maturity date.

** Promotional Annual Percentage Yield (APY) of 2.00% effective as of 04/12/2018. 14-month CD is a limited time offer and available as fixed CD only. APY and promotion period are subject to change at any time without notice. A minimum opening deposit of $50 is required to earn interest and to obtain the promotional APY. Maximum deposit allowed is $100,000 per member. One CD per member. Additional deposits to principal during promotional term are allowed. At maturity, CD will roll into an 18-month term. A penalty will be imposed for early withdrawal before maturity. Fees could reduce earnings on the account. Advertised APY cannot be combined with any other offer. Membership eligibility required. Certain restrictions may apply. Federally insured by NCUA.

| Account Type | Annual Percentage Yield (APY) | Minimum Initial Deposit |

|---|---|---|

| 11-month | 1.95% | $5000 † |

* Early withdrawal penalty may be imposed for withdrawal of principal before the maturity date. Only one withdrawal without paying a penalty will be permitted with the SuperFlex CD; the balance remaining must be at least $1,000.

† Minimum balance to earn interest on SuperFlex CD is $1,000.

| Account Type | Annual Percentage Yield (APY) | Minimum Initial Deposit |

|---|---|---|

| 60-month | 2.50% | $500 † |

| 48-month | 2.35% | $500 † |

| 36-month | 2.30% | $500 † |

| 24-month | 2.20% | $500 † |

* Early withdrawal penalty may be imposed for withdrawal of principal before the maturity date.

** Excludes Roth IRA

* Promotional Annual Percentage Yield (APY) of 2.20% effective as of March 1, 2019. Limited time offer available on 24-month bump-up products only. APY and promotion period are subject to change at any time without notice. A minimum opening deposit of $500 is required to earn interest and to obtain the promotional APY. Maximum deposit allowed is $250,000. One CD per member. Our bump-up feature allows you to increase your interest rate/APY one (1) time during the CD term if applicable interest rates increase during the CD term. If you choose to exercise the rate increase option, the new interest rate and APY will be in effect for the remainder of the CD term. At maturity, CD will roll into a 24-month bump-up term. A penalty will be imposed for early withdrawal before maturity. Fees could reduce earnings on the account. Advertised APY cannot be combined with any other offer. Membership eligibility required. Certain restrictions may apply. Federally insured by NCUA.

| Account Type | Annual Percentage Yield (APY) | Minimum Initial Deposit |

|---|---|---|

| 12 Months | ||

| $25 to $499.99 | 1.55% | $25 † |

| $500 to $4,999.99 | 1.65% | $25 † |

| $5,000 or more | 1.75% | $25 † |

| 24 Months | ||

| $25 to $499.99 | 1.85% | $25 † |

| $500 to $4,999.99 | 1.95% | $25 † |

| $5,000 or more | 2.05% | $25 † |

** Excludes Roth IRA

† Minimum balance in order to earn interest.