Benefits of a Cash-Back Rewards Credit Card

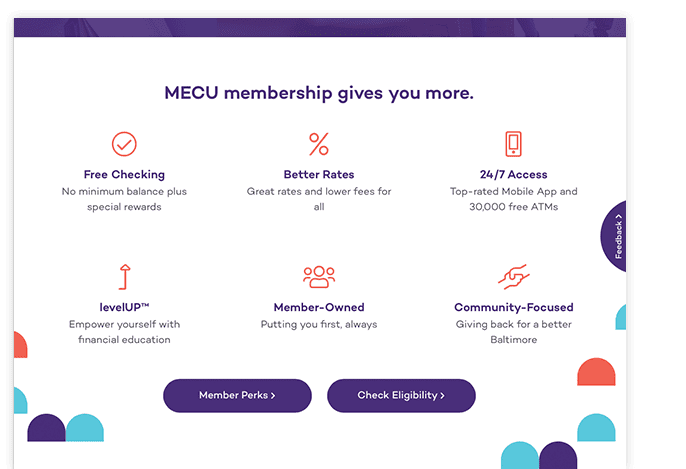

It’s like getting a sale price every time you pay for something. Discounts on fine dining. Deals on home décor. Bargains on beer and wine. Rebates on car repairs.How do you qualify for such a financial bonanza? A cash- back credit card can be the credit card option you are looking for. Here at MECU, we offer the Visa® Signature Cash Rewards Credit Card with unlimited 1% cash back on every purchase.

Credit cards that let you pile up points with each purchase and earn rewards for travel services, gift cards or other items have become popular in recent years. Almost half of all credit cards now offer these sorts of incentives, up from around a quarter in 2013. An even more recent trend is cards that focus on offering cash back.

Are these cards good deals? They can be. It all depends on several factors, ranging from your credit score to your buying habits to your ability to read the fine print and understand the nuances of the cash-back offers.

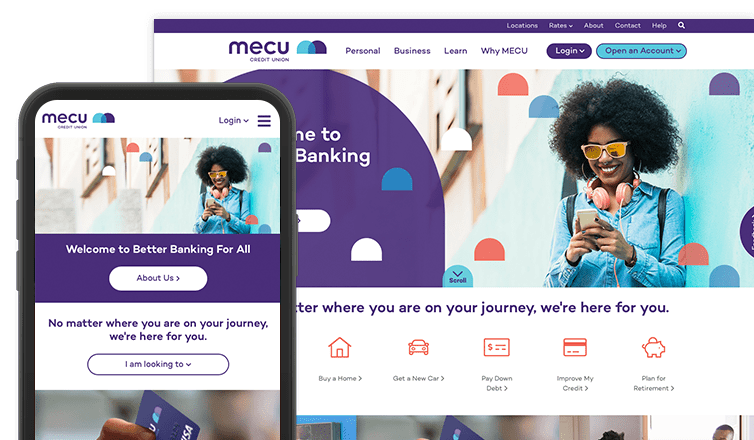

The good news is that MECU offers credit cards for all different lifestyles. If you’re unsure which one is the best fit for you, just give us a call or visit one of our Baltimore branches.

How Does Cash Back Work?

On the surface, it seems straight-forward. You pay for something with a credit card, and then you get a percentage of the price refunded. With most cards, you can put the money toward your credit card balance, have it sent to you as a check, or arrange for it to be deposited in your account.

But dig deeper, and things aren’t always so clear-cut. For example, some cards refund a flat percentage of your purchases, usually 1% or 2%. Others give greater weight to certain products or services, such as plane tickets, hotel stays, gasoline or even office supplies. One popular card offers 6% back on grocery purchases.

Further, some card issuers offer bonuses for spending a certain amount within a specified length of time, or during a certain season of the year. Some cards even have rotating categories, requiring consumers to keep track of which purchases might save them the most.

The bottom line: You should make the effort to understand what each card is offering. Review your monthly purchases. How much do you really spend on gas? Groceries? Restaurant meals? Once you’ve crunched the numbers, you’ll have a better idea which card may be best for you.

Who Benefits from Cash-Back Cards?

Some types of people might clearly benefit from cash-back cards, while others might not. Some factors to consider:

- Credit Score: Most credit card companies won’t issue cash-back cards to people with poor credit. You’ll probably need a FICO score of at least 670 to qualify. MECU can help you learn your credit score and offer advice on how to improve it.

- Monthly Payment: You’ll reap the most benefits from a cash-back card if you pay your credit card bill in full every month. Why is that? If you frequently leave a sizable balance, you’ll end up paying a lot of money in interest charges and cancel out your cash-back savings. The fact is, many cash-back cards carry above-average interest rates.

- Shopping Willpower: As with any credit card, cash-back cards work best when you make wise purchasing decisions. Getting discounts on items you would buy anyway is a smart move. But some consumers see every opportunity to use a cash-back card as a chance to “make” money, and they then run up big balances on impulse purchases.

- Smart Saving: Many savvy consumers make a cash-back card part of their savings plan. Instead of spending the money they get back, they have if funneled to savings or Money Market accounts to help them build financial security. You can ask our team at MECU how this approach might work for you.

- Other Perks: Though cash might be your priority, you should consider the additional benefits various cards offer. These may include special access to events, fraud and ID theft protection, extended warranties on purchases, free roadside assistance, and lost luggage reimbursement.

- Minimum Thresholds: With many cards, you can’t get your cash exactly when you want it. Often, you must hit a minimum spending threshold first. On the plus side, cashing out is usually easy. Most cards let you set up online accounts, and it only takes a minute or two to direct your money to the proper place.

- Sign-On Bonuses. Some cards try to entice consumers with sign-on bonuses of several hundred points. This can be a great deal. However, sometimes the bonus points kick in only if you spend a certain amount during an introductory period. Spending a lot at one time can drive up your balance and lead to higher interest payments.

- Fees: Like other credit cards, some cash-back cards charge annual fees. Again, you should crunch the numbers to make sure you’re likely to save more on your purchases than you’ll spend on fees. (While you’re at it, also check out how much certain cards charge for balance transfers, late payments and foreign transaction fees).

Actions Items: How can I check if this is the right solution for me?

- What is your credit score?

- Check your FICO score – you will need higher one for cash back cards.

- Visit our blog to learn more about how to fix less than perfect credit scores.

- What do you spend money on every month?

- Review your monthly purchases. Understanding where you spend the most money, especially on recurring charges like groceries and gas, will help you to understand which card may be best for you.

- Can you pay the balance in full every month?

- Holding a balance on a cash back card may negate the rewards by charging extra fees. Is this a card that you can use to pay for everyday expenses and pay it off at the end of the month?