How to Get Out of Debt

It’s no secret. Americans really know how to get into debt. In 2017, the total debt of all U.S. households was a whopping $905 billion.On a more personal level, the numbers are even more eye-popping. The average family with credit card debt owes more than $15,500. Even that pales next to averages for auto loans (about $28,000 per household), student loans ($46,600) and mortgages ($174,000).

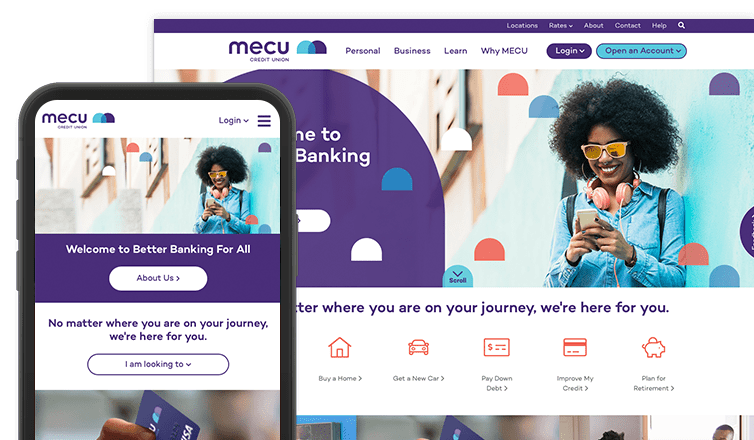

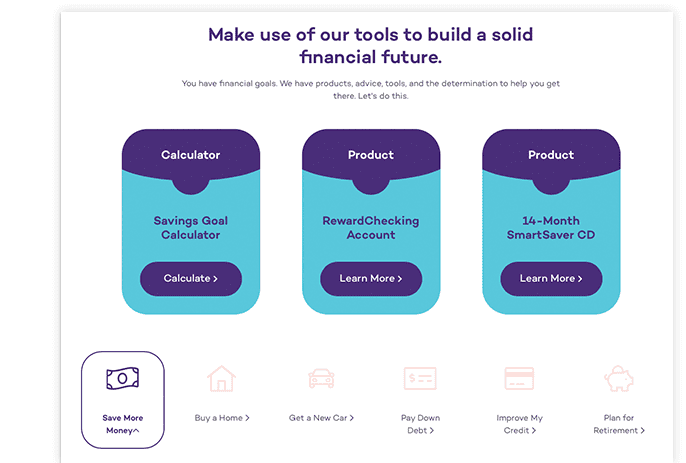

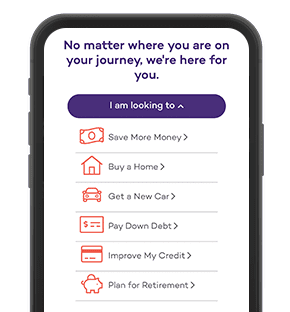

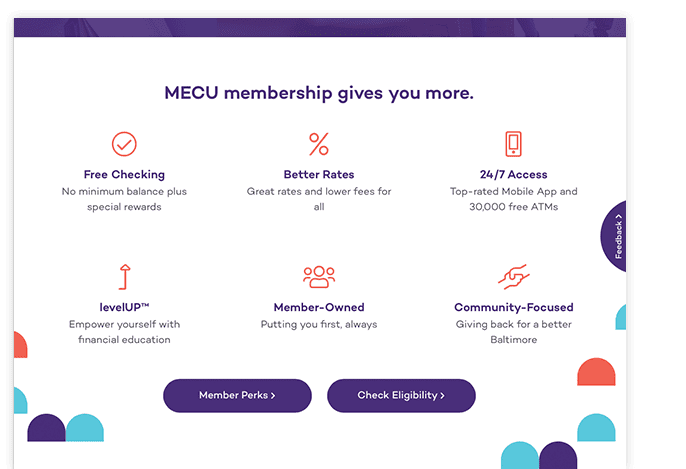

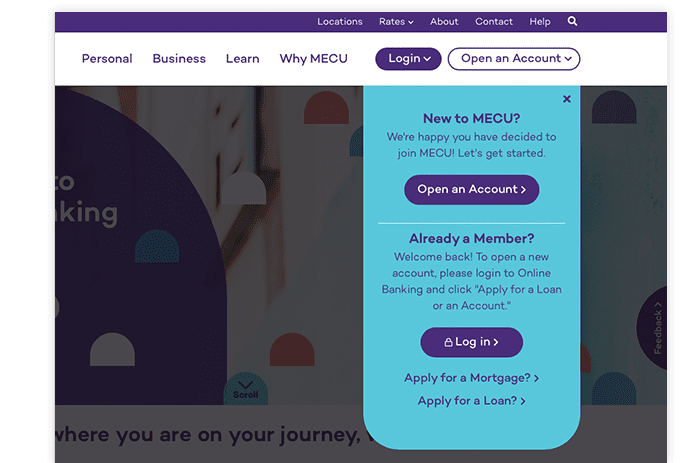

However, fewer Americans understand how to get out of debt. It starts with willpower. But there are also proven financial strategies that can really pay off. Fortunantly, your local credit union, like MECU, has many products and services that can steer you in the right direction. These include everything from low-interest debt consolidation loans to attractive credit card options to consumer counseling services.

Make the Commitment

If you’re carrying a large debt load, be prepared to spend about 15% of your income on reducing it. Why so much? Because if you just make minimum payments on your credit cards and other loans, the interest charges will just continue to pile up.Online assistance. Consider buying debt-elimination software to help you run the numbers and set priorities. Popular choices include MoneyWell and Debt Analyzer.

Tighten the belt. To free up money for debt payments, you’ll need to reduce spending. Come up with a monthly budget, put it in writing and stick to it. Need a few money-saving ideas? Eat fewer meals at restaurants. Make fewer stops at fancy coffee shops. Cancel cable TV and opt for cheaper streaming services (hulu is a popular one with live TV options). Hunt for product discounts on websites such as Groupon and SnipSnap.

Bigger savings? Evaluate your insurance policies to see if you can find less expensive coverage that still meets your needs. MECU offers competitively priced options on life, auto and home owners policies. We even offer guidance on health insurance, as that can be a source of big fluctuations in income.

Dealing With Cards

Credit cards offer convenient buying power and can earn valuable rewards for consumers. The problem comes when we charge too much, don’t pay down the balance fast enough and the interest charges pile up.

Set priorities. If you have multiple credit cards, identify the one with the highest interest rate. Pay as much as possible each month on that card. Make minimum payments on the others. When that first card is paid off, switch the biggest payment to the card with the second highest interest rate, and so on, until your debt is gone.

Zeroing in: Another technique is to apply for a new card that offers 0% interest for a certain period, often 12 to 24 months. Then transfer all outstanding balances to the new card. This will buy you time to pay down the balance without accruing new interest charges. MECU offers a choice of credit cards that can help keep your debt under control.

Loan Arrangements

People need to buy homes and cars and send their children to college. It can be an excellent investment to borrow money for these purposes. But keeping up with all the payments can be a challenge.

Manageable mortgages. Most homes are financed with 15- or 30-year mortgages. But you’re not obligated to keep the original loan that long. If interest rates drop, consider refinancing. Just a 1% rate reduction can trim payments on a $200,000 mortgage by well over $100 per month. Even if rates haven’t dipped, switching to a loan with a longer payoff period will reduce monthly payments and free up money to pay off shorter-term debt. Loan officers at MECU can explain our many refinancing options.

Shift gears. Consumers often drive away from an auto dealer with a vehicle they love and a loan they don’t. The solution is to trade in that unsatisfactory auto, motorcycle and RV loan. Refinancing to a lower interest rate or longer repayment period will reduce monthly payments and the stress on your household budget. MECU offers a wide range of options on auto loan refinancing.

School of finance. Student debt can crimp anyone’s lifestyle. One solution is to consolidate all those years of school loans into one new loan to reduce your overall monthly payments and simplify your finances. College grads with federal loans only can apply for a Direct Consolidation Loan. Visit the MECU personal loan consolidation calculator for more help calculating what you have left.

Get it together. Debt consolidation can also be a good strategy for other consumers. MECU offers great rates on personal loans, home equity loans and home equity lines of credit. You can use money from those sources to pay off credit card balances, medical bills, and even school loans, and bring your debt situation under control.

A final word. Beware of debt relief companies and their breathless offers. Many are scams, according to the Federal Trade Commission. Find out who is legit by contacting your state Attorney General’s Office or consumer protection department.

Feel free to contact us or visit any of the MECU branch locations for help with this and more. Reaching out to our financial planners can be a great place to start.