Switch Guide

Open an AccountReady to make the move to MECU? Here's everything you need to know.

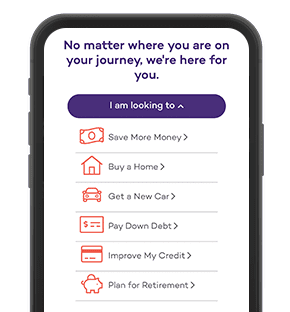

Sometimes change is hard. Like when you start a new job. Or move to a new city. But making the change from another financial institution to MECU is simple and straight-forward. We're happy to offer a few tips to help you make a fast, smooth transition.Follow these simple steps to make the switch without a hitch

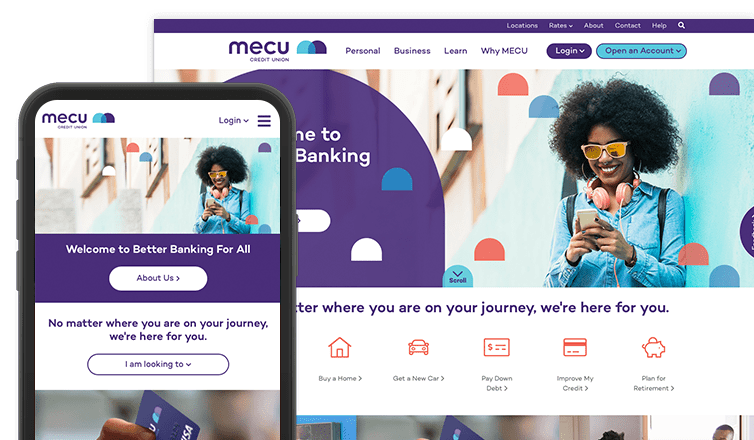

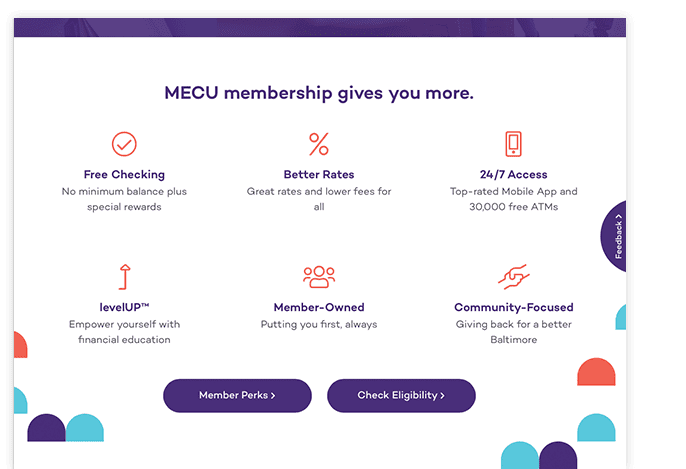

When you open an MECU checking account, you'll pay no monthly maintenance fees, enjoy exceptional Online and Mobile Banking tools and have the opportunity to earn interest on your balance or cash back on debit card purchases. If that sounds good to you, let's get started.

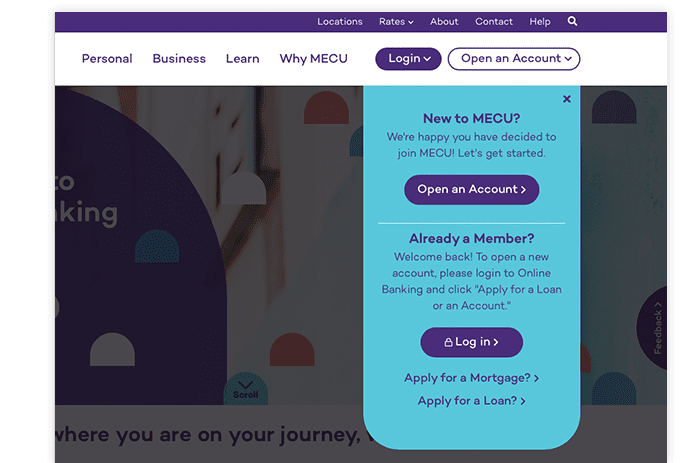

- Open a MECU account. You can do that right online.

- Close your old account. But first make sure that all outstanding checks have cleared.

- Sign up for Direct Deposit. You'll need your MECU account number, MECU's routing number (252076468), and your employer's (or other depositor's) name and address

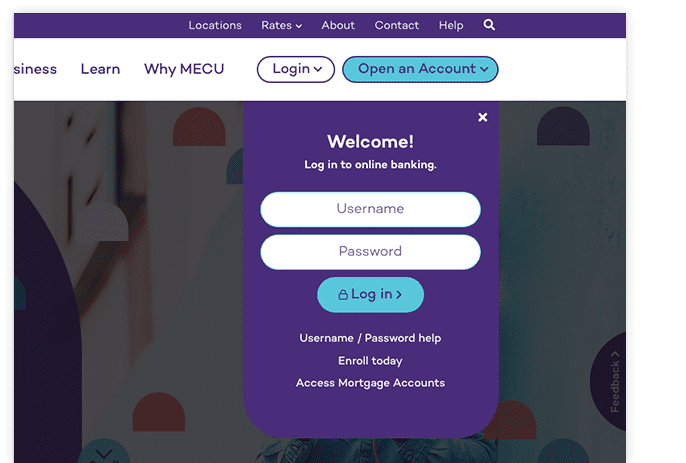

- Enroll in Online Banking. You'll have 24/7 access to your MECU accounts. Monitor your balances, transfer funds, make payments, and request specific account notifications.

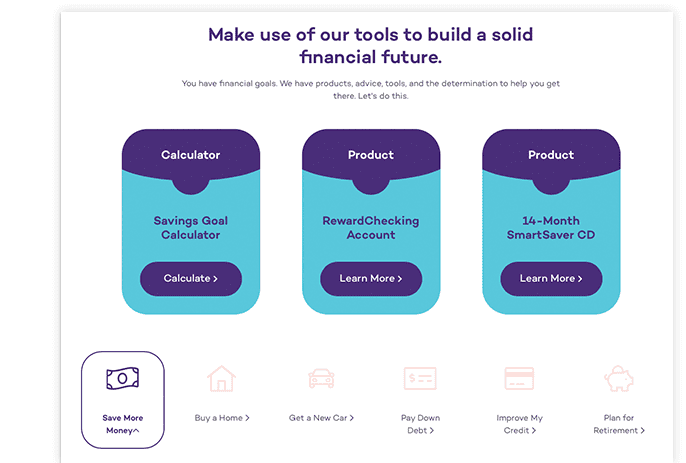

- Set up Online Bill Pay. Make one-time or recurring payments with the click of a mouse. Transfer any automatic payments from your old bank by providing the appropriate businesses or other organizations with your new checking and routing numbers.

- Sign up for Overdraft Protection. MECU's Preferred Credit is a line of credit that can be used for fast loans or for overdraft protection for checking accounts. Individuals can apply online or at any branch. Small business owners should call 443-263-4290 or email business@mecu.com.

- Set-up automatic, recurring transfers. This Online Banking service automatically transfers money from your checking account to your savings account.

- Activate your debit card. Use the easy-to-follow instructions that came with the card.