Should I Refinance My Car Loan?

Americans spend a lot of time shopping for cars. They stroll through dealerships, browse the web and study articles in auto-oriented magazines. With so much research in hand, it makes sense that they’re often happy with the car, pickup, SUV or van they end up buying.But consumers tend to spend much less time thinking about refinancing their car loan. And so they often end up with a loan they’re less pleased with. The good news is that, just as you can trade in a car, you can trade in your original loan for a better one.

The process is called refinancing. And though it’s often discussed in terms of getting a new mortgage for your house, you might be able to save yourself some valuable cash each month if you refinance your car loan.

How do you know if refinancing an existing vehicle loan is right for you? Here are five situations where it may be a good idea to consider applying for an Auto Refinance Loan from MECU.

Your original loan is from an auto dealer

- Scenario: Dealers often do business with several banks and lending companies. But they’re not usually seeking the best deal for you. Instead, they may steer you towards a loan that gives them a bigger profit. In fact, some lenders pay dealers a commission. What’s more, some allow the dealer to mark up the lender’s interest rate by several percentage points and pocket the difference.

- Refinancing Result: One study by the nonprofit Center for Responsible Lending found that the average loan rate mark-up was 2.5 percentage points. So, simply refinancing the loan back to a fair market rate can save you hundreds of dollars in interest charges over the course of the loan.

Overall interest rates have dropped

- Scenario: You financed your vehicle through an honest dealer or a bank with a great reputation. When you took out the loan, you were certain you were getting a fair deal. But in the years since then, national lending rates have fallen considerably.

- Refinancing Result: On average, Americans pay about $32,000 per vehicle. On a 60-month loan, if you can refinance to an interest rate that’s 2 percentage points lower, you can save about $30 a month. That adds up to a tidy $1,800 over the life of the loan!

You need to increase your cash flow

- Scenario: When you bought your vehicle, you chose a loan with a short repayment period, perhaps three years. Since then, your finances have changed. You lost your job. Or had a baby. Or bought a house. In any case, that high monthly car payment is putting a big hole in your budget and stress on you.

- Refinancing Result: To reduce your monthly payments, you can extend the length of the loan. Let’s say you’re paying off a $25,000 loan at 3.5% interest. On a 36-month loan, your monthly payment would be roughly $730. If you refinance to 60 months, your monthly cost would drop to $455.

Your credit score has improved considerably

- Scenario: When you bought your car, you were struggling financially. Maybe you had just graduated from college. Or you had a low-paying job. Or had run up some debt. That means any loan you got probably came with a high interest rate. But now things have changed. You’ve got a good-paying job and have wiped out a lot of your debt. Now, your credit score might help you refinance your car or truck.

- Refinancing Result: Credit scores are three-digit numbers that summarize your financial history. They play a large role in determining whether you qualify for loans and the rates you get. A higher score means you’re considered a better credit risk. If your financial turnaround has pushed your score above 700, you probably can qualify for a quite favorable refinancing rate.

Your car is not aging as well as your loan is

- Scenario: The vehicle you purchased is not as great as you thought it was, and it’s starting to break down. Or your car is fine, but you’ve put a lot of miles on it due to your job commute or vacation travel. In any case, you doubt the vehicle will last until your current loan is paid off.

- Refinancing Result: In this case, it makes sense to refinance to a shorter loan period. Yes, that will increase the monthly payments in the short term. But there will be long-term savings. First, you’ll pay less in interest charges with a shorter-term loan. Second, you won’t have to make two sets of car payments when you buy your next vehicle. And third, you might get a better interest rate when you finance your next car or truck if you’re not carrying as much debt.

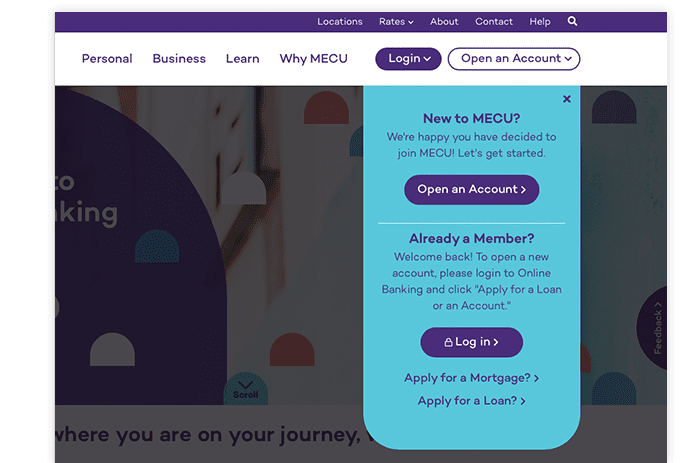

Still deciding whether you should refinance your vehicle loan? Discover how much you can save with our auto loan calculator. When you are ready to apply, you can access our easy-to-use online application. For extra assistance, contact us and our expert loan advisors can guide you through the loan application process and answer any questions that you have about refinancing your loan.