Protecting Yourself Against Debit Card Fraud

When you make a purchase with a debit or credit card, are you worried about being ripped off? It’s hard not to be these days, given the frequency of reports about data breaches and identity theft. On top of it, there are continual warnings about scammers “phishing” for credit card numbers using bogus emails and websites.Given the focus on credit cards, you might be surprised to learn that consumer experts are equally concerned with fraud involving your “other plastic,” your debit/ATM card.

A quick look at debit card fraud statistics:

- In 2016, FICO, the credit rating company, reported a 70% increase in fraud.

- In 2017, the increase slowed to 10%, as more banks and credit unions equipped their cards with EMV security chips.

Instead, consider three other ideas:

- Take precautions when using your card.

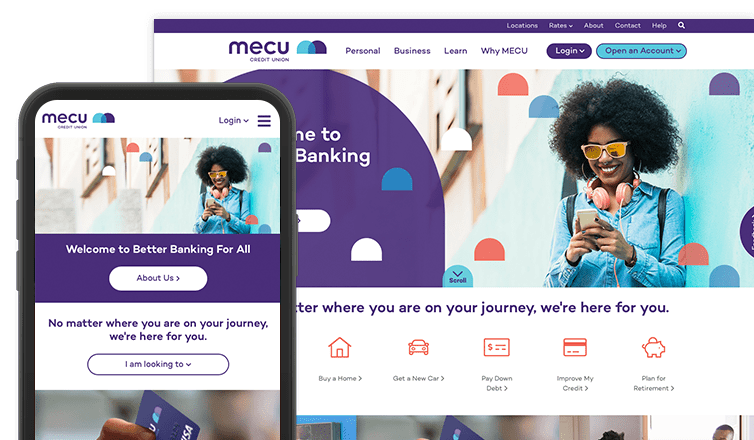

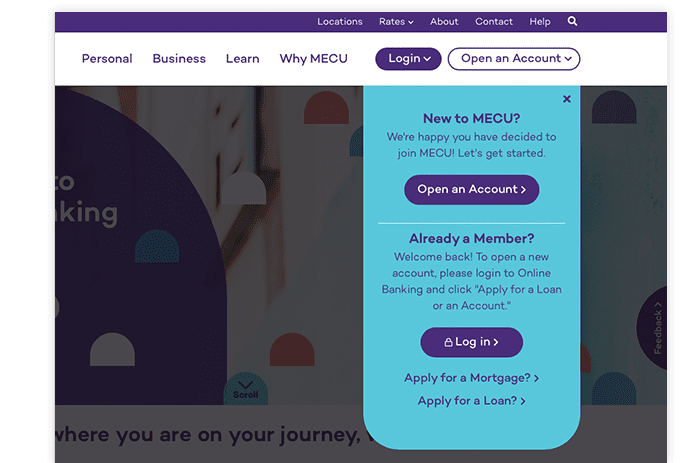

- Monitor your checking account for unauthorized transactions, using our online banking tools.

- Know what to do should you have a problem.

Beware of Skimmers at Unknown ATMs

How can someone use your debit card without having the card? Those same phishers also pursue debit card information online. Dishonest employees can eyeball your card and PIN numbers when you make a retail purchase. And, checkout terminals at retail stores can be hacked.And then there’s the “skimmer.” Put simply, small devices with tiny cameras can be secretly attached to ATMs or retail terminals and illegally record every debit card transaction. So watch for anything unusual near the card entry slot when you use retail terminals or ATMs. Of course, sophisticated scammers often place skimmers inside terminals, where they can’t be seen. But if your card doesn’t enter the slot smoothly, that can be a warning sign.

See the Light

It’s best to use only ATMs that are inside of or adjacent to credit unions. They tend to have better security than machines at convenience stores, restaurants and other places.Otherwise, choose ATMs in well-lighted areas. “Bad guys” often avoid locations where they might get caught installing a skimmer.

The “well-lighted” rule goes for other places, such as gas stations. If you’re paying with a debit card, use a pump that’s close to the building. Better yet, walk the card inside and pay at the counter.

And avoid using debit cards in establishments with high employee turnover, such as restaurants and low-end retailers. These types of places simply don’t do the type of background checks that might detect dishonest applicants.

Monitor Your Account

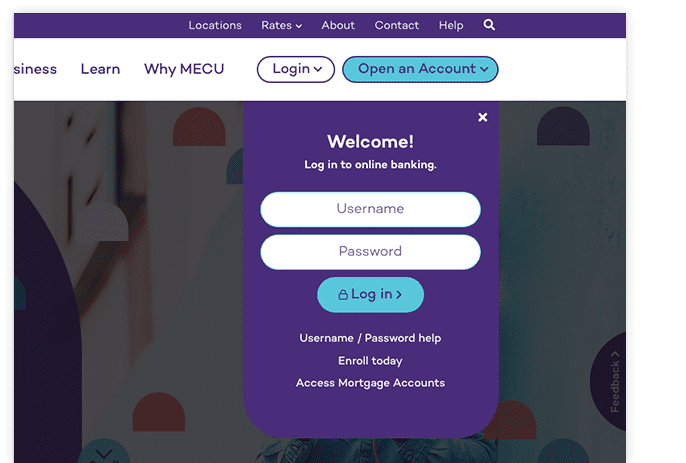

One silver lining with debit card fraud -- it’s fairly easy to spot. Consumer advocates suggest you take these steps:- Use online banking. Check your balance and recent transactions daily, looking for purchases or withdrawals you didn’t make.

- Sign up for alerts. At MECU, we’re always on the lookout for unusual activity in your account. We’ll contact you by email or text if we see anything that looks suspicious.

- Switch to e-Statements. If you miss something while monitoring online banking, you might see it while viewing your monthly electronic statement. Signing up for e-Statements through our online or mobile banking portals also eliminates the possibility of having account information stolen from your postal mailbox.

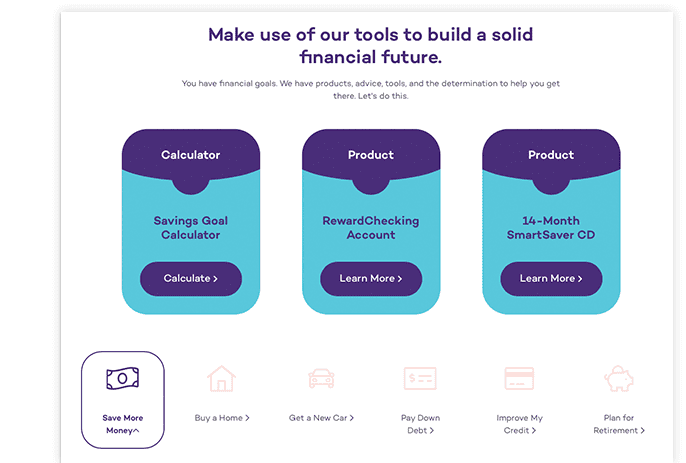

- Keep several accounts. Checking accounts are great places to keep money for everyday expenses. But consider moving extra cash into savings accounts, Money Markets, or Certificates. Doing so could limit the financial damage should you become a debit card fraud victim. Plus, you’ll earn interest on your deposits.

Report Problems Quickly

Visa, Mastercard and other credit card companies have their own fraud response programs. They can spot problems when a card is used improperly, or when questionable charges first appear on your bill. That allows you to address the situation before paying for items and services you didn’t really buy or authorize.Credit unions also offer their own debit card fraud protection. If you notice problems with your account, contact your financial institution immediately. You can reach us 24/7 at 410-752-8313, toll-free 800-248-6328 or by via our contact us page. Scammers often make withdrawals on an account over and over until the debit/ATM card is canceled.

There are also federal debit card fraud laws to protect you. If you report unauthorized card use within two days, your losses are limited to $50. But you risk losing up to $500 if you wait up to 60 days to make a report. Longer than that? You could permanently lose everything taken from your account.

At MECU, we share your concerns about debit card fraud. Please contact us with any questions or to report problems with your account immediately.